The $3 Billion Training Gap

Why record-breaking regulatory fines are just the symptom of a deeper failure in enterprise knowledge transfer

In October 2024, TD Bank was hit with a record $3.09 billion fine for money-laundering violations. While the headlines focused on the scale of the penalty, compliance officers focused on a specific detail in the consent order: The systemic failure to ensure employees understood and applied policy in real-time.

This isn't an isolated incident. Across the globe, regulatory penalties are decoupling from previous norms. We are entering the era of the $1B+ fine.

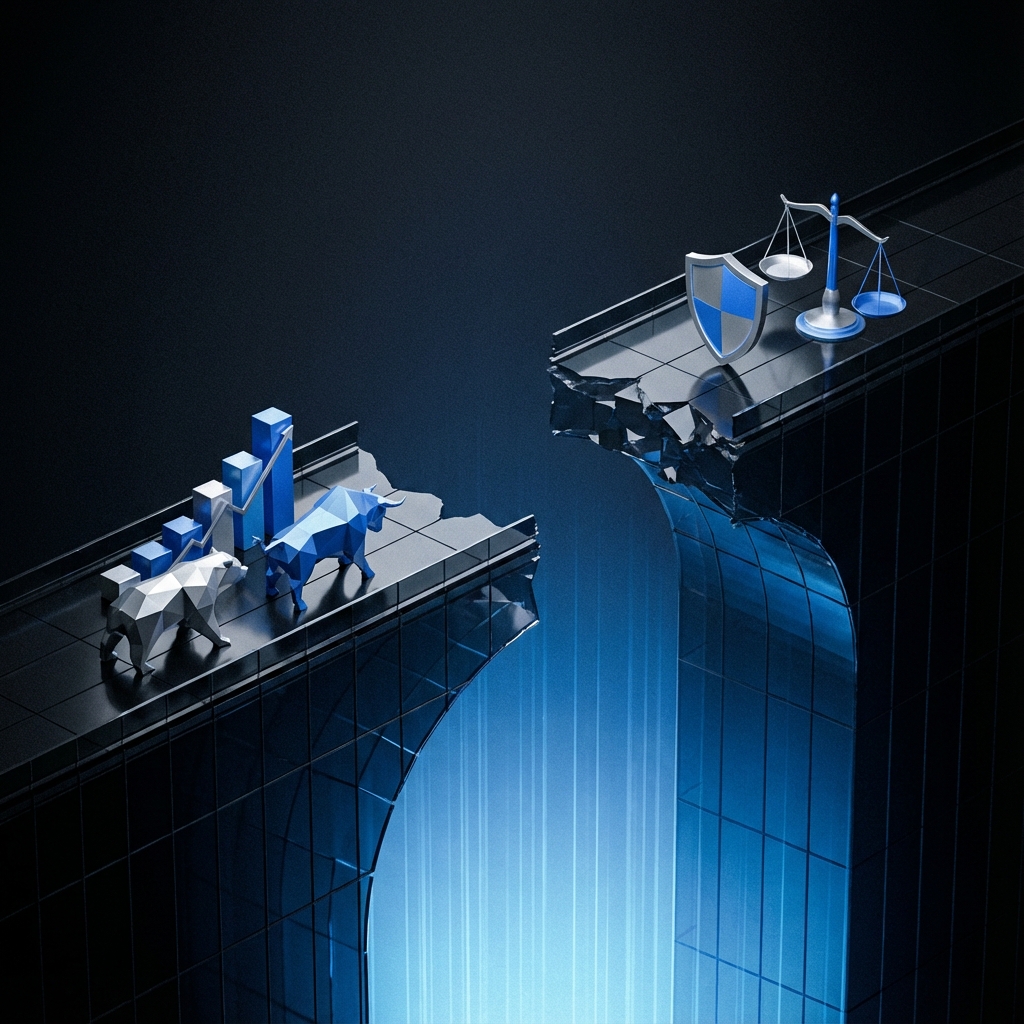

But the root cause isn't just lack of supervision. It's the Training Gap.

The Expensive New Reality

Traditional compliance training follows a predictable cycle: A regulation changes, the legal team writes a 40-page memo, the L&D team takes 12 weeks to build a SCORM module, and then employees click "Next" until they reach the quiz. This leads to several critical points of failure:

- The Knowledge Lag: By the time the training is deployed, the regulation has often been in effect for months.

- The Performance Gap: Passing a multiple-choice quiz about anti-money laundering doesn't mean an employee knows what to do when they see a suspicious transaction at 4:45 PM on a Friday.

- The Verification Void: Regulators no longer accept "Completion Rates" as proof of effectiveness. They want proof of understanding.

Where Traditional Training Fails

The core problem is that traditional training is decoupled from the documentation. The source of truth (the policy) lives in one place, while the training (the derivative) lives in another.

When the policy changes, the training becomes "stale" immediately. This staleness is what leads to the multi-billion dollar failures we see today. The gap between what is legally required and what the employee actually knows is the space where risk lives.

"Regulators are moving away from 'check-the-box' compliance. They are looking for organizations to prove that their knowledge base is grounded in reality."

The Invisible Cost of Lag

Beyond the fines, there is the massive internal resource drain. Organizations spend thousands of hours manually updating training content. This is why training takes so long—the development overhead is simply too high to keep up with the pace of modern regulation.

Closing the Gap with AI

To bridge the $3 Billion Training Gap, enterprises need AI that actually works—not just an LLM that can summarize a PDF, but a system that can bridge the distance between policy and practice with verified accuracy.

This requires moving from "static modules" to "knowledge as a service"—where a common core of policy information informs both the search tools employees use and the training they receive. When the policy changes, everything else should update automatically.

The cost of staying with the old model is no longer just "inefficiency." It's an existential risk.

Mitigate Your Compliance Risk

See how Episteca ensures your employees always have access to the latest, verified policy information.

Book a DemoReferences

- U.S. Department of Justice. (2024). "TD Bank to Pay Over $3 Billion in Money Laundering Penalties."

- Financial Conduct Authority (FCA). (2023). "Review of Firms' Implementation of the Consumer Duty."

- Kaplan, R. S., & Mikes, A. (2012). "Managing Risks: A New Framework." Harvard Business Review.

- Baldwin, R., Cave, M., & Lodge, M. (2012). "Understanding Regulation: Theory, Strategy, and Practice." Oxford University Press.